Topia Integration for ADP: Automate Distributed Workforce Compliance

Multi-jurisdiction tax compliance has become a painful and expensive burden for organizations as state, local, and international tax authorities increasingly enforce their rules more aggressively. The recently launched Topia integration with ADP® aims to help companies automate the compliance process and eliminate the pain and cost of tax audits.

As just one example, the state of New York requires employers to withhold taxes on paychecks for any employee who spends 14 or more days in the state over the course of a year. Audit trend data exclusively secured by Topia, by way of a Freedom of Information Act request, revealed that New York state audited nearly 1,000 companies for nonresident payroll withholding during 2018, and it won 90+ percent of these types of audits. What’s even more painful is that for every $100 collected in payroll tax, New York collects $88 in penalties.

This audit trend could likely worsen as governments everywhere seek to recoup lost revenue during the economic slowdown caused by COVID-19 and adapt to the new realities of increasingly remote and distributed workforces.

In normal times, companies struggle to collect and act upon physical presence data that affects their tax exposure due to employee travel or a distributed workforce. Rather than simplifying compliance, COVID-19 has exacerbated the challenge. Now, most employees are working in different tax jurisdictions than their offices. Many employees are also working remotely during extended trips to care for family or just taking advantage of the flexibility to work from a more comfortable setting. Since most companies don’t really know where their employees are performing their work, such remote work during non-business travel may be creating tax exposures for companies and their employees alike that they are otherwise unaware of.

The Topia integration can help companies automatically identify and take control of these risks, ensure optimal compliance, and eliminate the pain of costly audits.

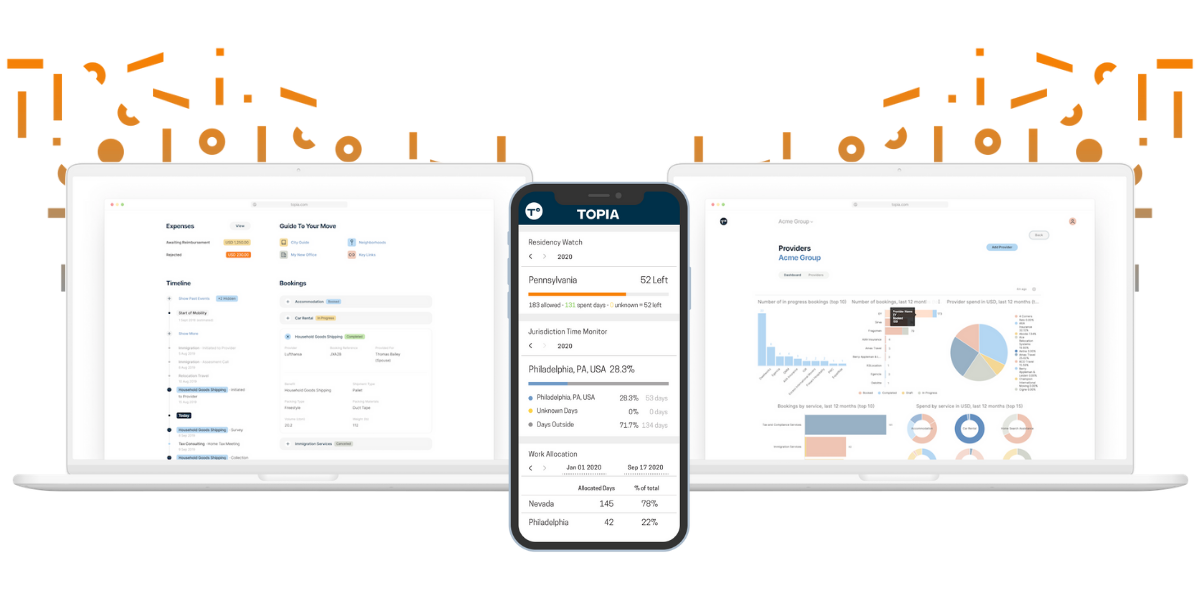

Topia Compass can now stay up-to-date in real-time with automatic data feeds via the Topia Compass Connector for ADP Workforce Now® and effortlessly calculate multi-jurisdictional payroll withholding apportionment. This solution can help Topia and ADP clients remain compliant, optimize their tax footprint to potentially lower taxes, and help protect them from the increasingly inevitable audits.

Topia Compass calculates tax exposure by gathering and analyzing expense transactions, travel bookings, timesheets, real-time physical presence data, and personnel records from enterprise systems. It then feeds the relevant calculations into various systems and processes, including payroll providers such as ADP to ensure accurate and timely non-resident payroll withholding. This digital approach can significantly minimize compliance costs while creating a robust audit trail for tax audit defense.

The Topia integration with ADP helps to enhance Topia’s Global Talent Mobility solution powered by the Topia One platform and furthers Topia’s mission to break down barriers between people and places so they can work everywhere. Learn more about the Topia Compass Connector for ADP Workforce Now® and the Topia Compass Payroll Withholding solution on ADP Marketplace. To learn more about Topia Compass, click here.