Financial and compliance implications of managing a distributed, remote workforce

In our last blog post, we discussed the flexibility that the future of work has in store for employees. That flexibility will, in some cases, include employees working remotely. However, as companies move to embrace remote work and a distributed workforce, there are new compliance considerations that HR, finance, and payroll teams will have to manage.

The ability to work remotely means that employees could be working anywhere in the world without HR or managers knowing. This creates a potentially massive compliance and financial risk.

How can remote work open up your organization to risk?

If an employee works remotely from their house in California, it is fair to assume they could do that same work in New York or London. And the intrepid employee may act on this idea to pick up sticks and relocate to another location for a week, a month, or even longer while still working as an employee in the state of California. If they do this without notifying their Manager and HR, they open themselves and their company to risk. Here’s how.

Different states and countries have different thresholds for the type of work and how many days an individual can be working within its borders before the individual and company owe taxes – or potentially more costly, inadvertently creates a permanent establishment.

For example, in the US, more than half of the states with a personal income tax require employers to withhold tax from a nonresident employee’s wages beginning with the first day the nonresident employee travels to the state for business purposes. Many states have different (and usually lower) standards for imposing tax on nonresidents. That is, the employee may owe tax even where the employer is not required to withhold tax. Things are equally complicated outside of the US. In the UK, the tax liability for revenue-generating employees begins as of day 60. In Europe, there is the Posted Workers Directive to contend with. And there are more than just tax and financial considerations. There are also work permit/visa/immigration concerns that must also be monitored.

Even if an employee does notify their manager of their intent to work from an alternative location for some time, will the manager know if that location creates a compliance risk? And do HR, payroll, and finance teams have the policies and structures to monitor and support an expanded distributed workforce. The effort in calculating multijurisdiction payroll withholdings alone could be prohibitively burdensome.

How can organizations enable remote work and reduce risk?

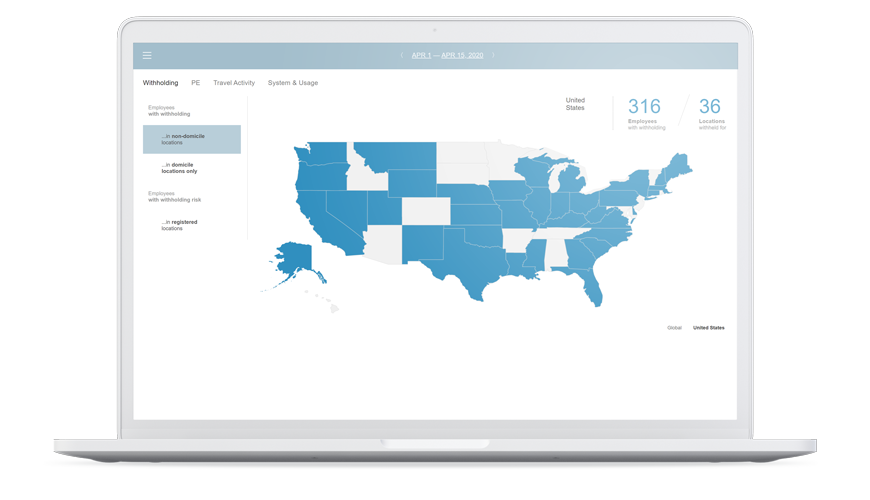

To protect employees and their businesses, HR, payroll, and finance teams need a solution that can proactively track and report on global employee footprint – flagging potential compliance issues before they arise – and determine where and how much tax withholding to account for. This is exactly what the Topia Compass solution helps organizations do today. By pulling in data from a variety of sources, including travel bookings, HRIS data, and in-device apps, organizations can have an accurate view of where employees are at all times. And by integrating with payroll systems, the payroll withholding process can be automated.

In our next post, we’ll take a look at how letting employees work remotely can stand to save businesses money – if they can prove employee location – taking a look at New York City’s UBT as one example use case.

.png)